From time to time, we at eQuoteMD like to choose a particular specialty to address. Today we’re talking aboutpodiatry malpractice insurance, and we have one primary message: consider a specialized provider like the Podiatry Insurance Company of America (PICA).

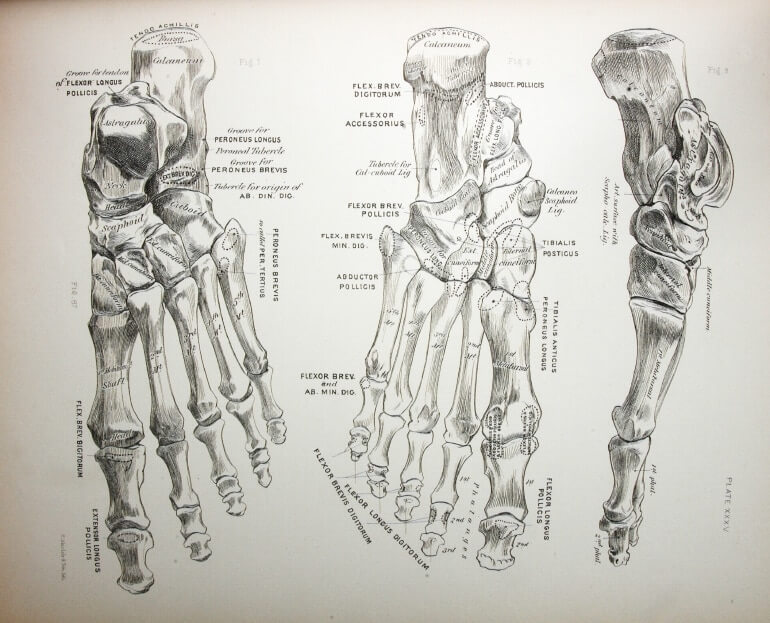

Podiatry is a specialty with unique risk management challenges best addressed by a podiatry malpractice insurance provider dedicated to the specialty. Podiatry is a relatively high-risk specialty because of both what it involves and whom it involves. Our feet are extremely important to our quality of life and they are also very complex, and in some ways fragile parts of our bodies. While the vast majority of the time podiatrists are able to offer quality care that improves people’s mobility and enjoyment of life, the fact is that there are going to be occasional instances of malpractice, but also there are going to be cases brought against doctors by people who have experienced adverse circumstances, whether their doctor was truly at fault or not. And, because our feet are so fundamental to mobility and quality of life, these patients are going to be seeking significant compensation in the suits they file.

In addition to the inherent liability risk of working with such a complex and vital part of the body, podiatrists have to consider their clientele when thinking about podiatry malpractice insurance. Our feet are prone to stress injuries because they are always being used and they are under constant pressure. And what contributes to stress injuries? Use, of course, and the older you get the more use your feet have endured. So the end result is that podiatrists often spend a lot of time with older patients, and even patients in nursing homes or assisted living situations. And with an elevated percentage of older patients comes more likelihood of adverse outcomes and thus increased risk.

Because of these factors and others some malpractice insurers have historically tended to shy away from podiatrists. This has led to podiatrists forming their own insurers, focused specifically on insuring other podiatrists, as well as providing them with tools, resources, and educational opportunities.

Perhaps the most well known provider is PICA, a company that insures around 70% of all podiatrists in the nation. Initially formed as a mutual company by a group of podiatrists, PICA became a ProAssurance company several years ago, gaining greater stability while continuing to serve the community it has been insuring for over 35 years now.

What makes specialized providers like PICA so valuable is their ability to focus in on the specific needs of doctors in the specialty they serve. So for instance, doctors are able to call providers like PICA at anytime, even during a surgery, to speak to a risk management consultant on staff to get risk mitigation advice on specific questions or potential communication issues.

Another service that these types of insurers can provide that can really provide some peace of mind is legal counsel that specializes in and has experience with defending your particular specialty. It’s one thing to know you have good defense attorneys working for you should a claim arise, but it’s another to know you have attorneys that have specifically defended dozens of other cases brought against doctors in your specialty, and that have a specialized knowledge of the field.

These kinds of perks make coverage with a specialized carrier a great option. Not all specialties have insurance companies that specialize in insuring their specialty, but since podiatrists do we would recommend seriously considering that option. One of our partners, the Keane Insurance Group Inc., recently added PICA to the list of providers that they are able to access when you get a quote through them. The Keane Insurance Group is one of the largest independent brokers of medical professional liability insurance in the country and can help you find the coverage you need for podiatry malpractice insurance at the best price available. Or you can just get a podiatry medical malpractice insurance quote from us by clicking here.